UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

|

| |

ý | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2018

OR

|

| |

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number: 001-37471

PIERIS PHARMACEUTICALS, INC.

(Exact name of registrant as specified in its charter)

|

| | |

Nevada | | EIN 30-0784346 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | |

255 State Street, 9th Floor Boston, MA United States | | 02109 |

(Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code

857-246-8998

Securities registered pursuant to Section 12(b) of the Exchange Act:

|

| | |

Title of each class | | Name of each exchange on which registered |

Common Stock, par value $0.001 per share | | The Nasdaq Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Exchange Act:

None

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ☐ No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ý No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

|

| | | | | | |

Large accelerated filer | | ☐ | | Accelerated filer | | ý

|

| | | |

Non-accelerated filer | | ☐ | | Smaller reporting company | | ý

|

| | | | | | |

Emerging growth company ý | | | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ý

The aggregate market value of the registrant's common stock held by non-affiliates of the registrant on June 29, 2018, the last business day of the registrant’s most recently completed second fiscal quarter, based on the closing price on that date of $5.07, was $273,283,424.

As of March 11, 2019, the registrant had 49,151,219 shares of common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

None.

TABLE OF CONTENTS

Forward Looking Statements

This annual report on Form 10-K for the year ended December 31, 2018, or this Annual Report on Form 10-K, contains forward looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act, that involve risks and uncertainties, principally in the sections entitled “Business,” “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” All statements other than statements of historical fact contained in this Annual Report on Form 10-K, including statements regarding future events, our future financial performance, business strategy and plans and objectives of management for future operations, are forward-looking statements. We have attempted to identify forward-looking statements by terminology including “anticipates,” “believes,” “can,” “continue,” “ongoing,” “could,” “estimates,” “expects,” “intends,” “may,” “appears,” “suggests,” “future,” “likely,” “goal,” “plans,” “potential,” “projects,” “predicts,” “should,” “would” or “will” or the negative of these terms or other comparable terminology. Although we do not make forward-looking statements unless we believe we have a reasonable basis for doing so, we caution you that these statements are based on our projections of the future that are subject to known and unknown risks and uncertainties and other factors that may cause our actual results, level of activity, performance or achievements expressed or implied by these forward-looking statements, to differ. The description of our Business set forth in Item 1, the Risk Factors set forth in Item 1A and our Management’s Discussion and Analysis of Financial Condition and Results of Operations set forth in Item 7 as well as other sections in this report, discuss some of the factors that could contribute to these differences. These forward-looking statements include, among other things, statements about:

| |

• | the accuracy of our estimates regarding expenses, future revenues, uses of cash, capital requirements and the need for additional financing; |

| |

• | the initiation, cost, timing, progress and results of our development activities, preclinical studies and clinical trials; |

| |

• | the timing of and our ability to obtain and maintain regulatory approval of our existing product candidates, any product candidates that we may develop, and any related restrictions, limitations and/or warnings in the label of any approved product candidates; |

| |

• | our plans to research, develop and commercialize our current and future product candidates; |

| |

• | our collaborators’ election to pursue research, development and commercialization activities; |

| |

• | our ability to obtain future reimbursement and/or milestone payments from our collaborators; |

| |

• | our ability to attract collaborators with development, regulatory and commercialization expertise; |

| |

• | our ability to obtain and maintain intellectual property protection for our product candidates; |

| |

• | our ability to successfully commercialize our product candidates; |

| |

• | the size and growth of the markets for our product candidates and our ability to serve those markets; |

| |

• | the rate and degree of market acceptance of any future products; |

| |

• | the success of competing drugs that are or become available; |

| |

• | regulatory developments in the United States and other countries; |

| |

• | the performance of our third-party suppliers and manufacturers and our ability to obtain alternative sources of raw materials; |

| |

• | our ability to obtain additional financing; |

| |

• | our use of the proceeds from our securities offerings; |

| |

• | any restrictions on our ability to use our net operating loss carryforwards; and |

| |

• | our ability to attract and retain key personnel. |

Moreover, we operate in a very competitive and rapidly changing environment. New risks emerge from time to time and it is not possible for us to predict all risk factors, nor can we address the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause our actual results to differ materially from those contained in any forward-looking statements.

You should not place undue reliance on any forward-looking statement, each of which applies only as of the date of this Annual Report on Form 10-K. Before you invest in our securities, you should be aware that the occurrence of the events described in the section entitled “Risk Factors” and elsewhere in this Annual Report on Form10-K could negatively affect our business, operating results, financial condition and stock price. All forward-looking statements included in this document are based on information available to us on the date hereof, and except as required by law, we undertake no obligation to update or revise publicly any of the forward-looking statements after the date of this Annual Report on Form 10-K to conform our statements to actual results or changed expectations.

We have registered trademarks for Pieris® and Anticalin®. All other trademarks, trade names and service marks included in this Annual Report on Form10-K are the property of their respective owners. Use or display by us of other parties’ trademarks, trade dress or products is not intended to and does not imply a relationship with, or endorsements or sponsorship of, us by the trademark or trade dress owner.

As used in this Annual Report on Form10-K, unless the context indicates or otherwise requires, “our Company”, “the Company”, “Pieris”, “we”, “us” and “our” refer to Pieris Pharmaceuticals, Inc., a Nevada corporation, and its consolidated subsidiary, Pieris Pharmaceuticals GmbH (formerly known as Pieris AG), a company organized under the laws of Germany, Pieris Australia Pty Ltd., a company organized under the laws of Australia that is a consolidated subsidiary of Pieris Pharmaceuticals GmbH, and Pieris Pharmaceuticals Securities Corporation, a Massachusetts securities corporation, a consolidated subsidiary of Pieris Pharmaceuticals, Inc. Effective as of August 26, 2015 and with notification from the Amtsgericht München as of September 29, 2015, Pieris AG was transformed to Pieris Pharmaceuticals GmbH as a result of a change in the legal entity.

Currency Presentation and Currency Translation

Unless otherwise indicated, all references to “dollars,” “$,” “US $” or “US dollars” are to the lawful currency of the United States. All references in this Report to “euro” or “€” are to the currency introduced at the start of the third stage of the European Economic and Monetary Union pursuant to the Treaty establishing the European Community, as amended. We prepare our financial statements in US dollars.

The functional currency for our operations is primarily the euro. With respect to our financial statements, the translation from the euro to US dollars is performed for balance sheet accounts using exchange rates in effect at the balance sheet date and for revenue and expense accounts using a weighted average exchange rate during the period. The resulting translation adjustments are recorded as a component of accumulated other comprehensive loss.

Where in this Report we refer to amounts in euros, we have for your convenience also, in certain cases, provided a conversion of those amounts to US dollars in parentheses. Where the numbers refer to a specific balance sheet account date or financial statement account period, we have used the exchange rate that was used to perform the conversions in connection with the applicable financial statement. In all other instances, unless otherwise indicated, the conversions have been made using the noon buying rate of €1.00 to US $1.1450 based on Thomson Reuters as of December 31, 2018.

PART I

Corporate History

General

Pieris Pharmaceuticals, Inc. was incorporated in the State of Nevada in May 2013 under the name “Marika Inc.” Pieris Pharmaceuticals, Inc. began operating the business of Pieris Pharmaceuticals GmbH, or Pieris GmbH, through a reverse acquisition on December 17, 2014. Pieris GmbH (formerly Pieris AG, a German company which was founded in 2001) continues as an operating subsidiary of Pieris Pharmaceuticals, Inc.; Pieris Pharmaceuticals, Inc. is the sole stockholder of Pieris GmbH.

Pieris Pharmaceuticals, Inc.'s corporate headquarters are located at 255 State Street, 9th Floor, Boston, Massachusetts 02109. The research facilities of Pieris GmbH are located in Freising, Germany. Beginning in late 2019 we anticipate that the research facilities of Pieris GmbH will be relocated to Hallbergmoos, Germany. Pieris Australia Pty Ltd., a wholly-owned subsidiary of Pieris GmbH, was formed on February 14, 2014 to conduct research and development activities in Australia. Pieris Pharmaceuticals Securities Corporation, a wholly-owned subsidiary of Pieris Pharmaceuticals, Inc. was formed on December 14, 2016 to buy, sell, deal in, or hold securities on its own behalf and not as a broker, and will engage in its activities exclusively for investment purposes.

Business Overview

We are a clinical-stage biotechnology company that discovers and develops Anticalin-based drugs to target validated disease pathways in unique and transformative ways. Our clinical pipeline includes an inhaled IL-4 receptor alpha, or IL-4Rα, targeting Anticalin protein to treat asthma and an immuno-oncology, or IO, bispecific protein targeting HER2 and 4-1BB. Proprietary to us, Anticalin proteins are a novel class of clinically-tested therapeutics validated by partnerships with leading pharmaceutical companies.

Anticalin proteins are a class of low molecular-weight therapeutic proteins derived from lipocalins, which are naturally occurring proteins typically found in human blood plasma and other bodily fluids. Anticalin proteins function similarly to monoclonal antibodies by binding tightly and specifically to a diverse range of targets. An antibody is a large protein used by the immune system that recognizes a unique part of a target molecule, called an antigen. We believe Anticalin proteins possess numerous advantages over antibodies in certain applications. For example, Anticalin proteins are relatively small in size and monomeric, meaning they are comprised of a single polypeptide rather than a multi-polypeptide protein complex. Therefore, we believe Anticalin proteins are generally more stable biophysically than antibodies, which are composed of four polypeptide chains. The greater stability and small size of Anticalin proteins as compared to antibodies potentially enable unique routes of Anticalin protein drug administration such as inhaled delivery. Higher-molecular-weight entities, such as antibodies, are often too large to be delivered effectively through these methods. Our Anticalin technology is modular, which allows us to design multimeric Anticalin-based bi- and multi- specific proteins to bind with specificity to two or more disease targets at the same time. This multispecificity offers advantages in biological settings where binding to multiple targets can enhance the ability of a drug to achieve its desired effects, such as facilitating the killing of cancer cells. Moreover, unlike antibodies, the pharmacokinetic, or PK, profile of Anticalin proteins can be adjusted to potentially enable program-specific optimal drug exposure. Such differentiating characteristics suggest that Anticalin proteins have the potential, in certain cases, to become best-in-class drugs.

We have intellectual property rights directed to various aspects of our Anticalin technology platform, allowing for further development and advancement of both our platform and drug candidates. We believe that our ownership or exclusive license of intellectual property related to the Anticalin platform provides us with a strong intellectual property position, particularly in cases where we are seeking to address targets and diseases in a novel way and for which there is existing antibody intellectual property. We also believe that the drug-like properties of the Anticalin drug class have been demonstrated in various clinical trials with different Anticalin-based drug candidates, including PRS-060, PRS-080 and others.

Our core Anticalin technology and platform were developed in Germany, and we have collaborations with major multi-national pharmaceutical companies. We entered into a license and collaboration agreement, or the Servier Collaboration Agreement, with Les Laboratoires Servier and Institut de Recherches Internationales Servier, or Servier, in January 2017 in IO. In May 2017, we entered an alliance with AstraZeneca AB, or AstraZeneca, to treat respiratory diseases, and in February 2018, we entered into a license and collaboration agreement, or the Seattle Genetics Collaboration Agreement, with Seattle Genetics Inc., or Seattle Genetics, in IO.

In connection with our efforts to develop multispecific Anticalin-based proteins designed to engage immunomodulatory targets, we have gained non-exclusive access to antibody building blocks that can be utilized to develop multispecific antibody-Anticalin fusion proteins.

Our current development plans focus on two core pillars, respiratory diseases and IO.

The lead respiratory Anticalin-based drug candidate, PRS-060, binds to IL-4Rα, thereby inhibiting the actions of IL-4 and IL-13, two cytokines (small proteins mediating signaling between cells within the human body) known to be key mediators in the inflammatory cascade that drive the pathogenesis of asthma and other inflammatory diseases. We believe that the small size and biophysical stability of PRS-060 facilitates direct delivery to the lungs through the use of an inhaler, which may enable high pulmonary concentrations of the drug candidate to be achieved at lower doses than would be reached with antibodies that are systemically delivered. Further, we believe an inhaled drug may be better tolerated than systemically-administered antibodies. We completed a phase 1 single ascending dose, or SAD, study of PRS-060 and reported in November 2018 that PRS-060 was safe and well-tolerated by healthy volunteers participating in the trial. We have also initiated and continue to enroll individuals with mild asthma in a multiple ascending dose, or MAD, phase 1 study. This study will evaluate the safety, tolerability and fractional exhaled nitric oxide, or FeNO, reducing potential of PRS-060 versus placebo. Along with our partner AstraZeneca, we anticipate reporting the data from both phase 1 studies at future medical meetings.

We are sponsoring the phase 1 study for PRS-060, after which AstraZeneca will be responsible for further clinical development of PRS-060. We have the right to opt-into further co-development of PRS-060 with AstraZeneca after completion of the phase 2a study. We also have a separate option to co-commercialize PRS-060 with AstraZeneca in the United States. Beyond PRS-060, our alliance includes four additional Anticalin-based drug candidates for treatment of respiratory diseases and two new programs were initiated in 2018 as part of the collaboration. In addition, over the past year, we have initiated two new respiratory programs as part of our proprietary pipeline.

The lead IO Anticalin-based drug candidate in our pipeline, PRS-343, is designed to target the immune receptor 4-1BB and the tumor target HER2. PRS-343 is a genetic fusion of a variant of a HER2-targeting antibody with an Anticalin protein specific for 4-1BB. The proposed mode of action of this 4-1BB/HER2 bispecific is to promote 4-1BB clustering by bridging 4-1BB-positive T cells with HER2-positive tumor cells, thereby providing a potent costimulatory signal to tumor antigen-specific T cells. PRS-343 is intended to localize 4-1BB activation in the tumor, and to thereby both increase efficacy and reduce systemic toxicity compared to 4-1BB-targeting antibodies. Patient dosing in a multicenter, open-label, phase 1 dose escalation study commenced in September 2017. The study is designed to determine the safety, tolerability, and potential anti-cancer activity of PRS-343 in patients with advanced or metastatic HER2-positive solid tumors for which standard treatment options are not available, are no longer effective, or are not tolerated, or in patients that have refused standard therapy. Elevated HER2 expression is associated with multiple cancers, including gastroesophageal, bladder, breast, and a range of other tumor types. We continue to enroll and treat patients in this phase 1 dose-escalation study and intends to report comprehensive data from the study in 2019. We also continue to enroll patients in a dose escalation study of PRS-343 in combination with atezolizumab and intend to report data from this study in 2019.

In January 2017, we initiated a strategic collaboration with Servier to discover and develop five Anticalin-based bispecific therapeutics in IO. The lead program in the alliance is PRS-344, a PD-L1/4-1BB antibody-Anticalin bispecific, currently in investigational new drug application, or IND, -enabling studies. Preclinical data for the PRS-344 program were presented at the Society for Immunotherapy of Cancer, or the SITC, 2018 Annual Meeting. We have achieved two preclinical milestones under the program, one in December 2018 and another in February 2019, and intend to file an IND for the drug candidate in the second half of 2019. We also executed our option to opt-into co-development and US commercialization of PRS-344 during the first quarter of 2019.

In February 2018, we initiated a strategic collaboration with Seattle Genetics to discover and develop up to three Anticalin-based tumor-targeted bispecific therapeutics in IO. As part of the alliance, we have generated and characterized the first tumor-targeting bispecific for further evaluation and development by Seattle Genetics.

We continue to explore opportunities to develop additional differentiated Anticalin-based multispecific therapeutics in IO. We are performing proof of concept and proof of mechanism studies on additional fully proprietary programs to support drug candidate nomination.

The third clinical-stage Anticalin drug candidate, PRS-080, is a polyethylene glycol, or PEG, conjugated Anticalin protein that binds to hepcidin, a natural regulator of iron levels in the blood. An excess amount of hepcidin can cause functional iron deficiency, or FID, which often cannot be treated adequately with iron supplements and can lead to anemia. PRS-080 is designed to target hepcidin for the treatment of FID in anemic patients with chronic kidney disease, or CKD, particularly in

end-stage renal disease, or ESRD, patients requiring dialysis. We believe that by blocking the actions of hepcidin, PRS-080 may serve to address anemia by mobilizing iron from the endogenous iron stores in the body for incorporation into red blood cells. With a serum half-life of several days, PRS-080 was designed to inhibit hepcidin sufficiently to mobilize functional serum iron for erythropoiesis, followed by recovery of blood hepcidin levels to prevent iron overload.

PRS-080 has been investigated in SAD phase 1a and 1b studies, first in healthy subjects (1a), then in stage 5 CKD patients requiring hemodialysis (1b), as well as in a multidose phase 2a study in anemic stage 5 CKD patients requiring hemodialysis. In these studies, intravenous PRS-080 administrations were safe and well tolerated up to the tested dose of 16 mg/kg in healthy volunteers and up to the tested dose of 8 mg/kg in end-stage CKD patients. The phase 1a and 1b studies were completed in 2015 and 2017, respectively. Based on the phase 1 study results, a multicenter, randomized, double-blind, placebo-controlled, MAD (two cohorts of 4mg/kg and 8 mg/kg, respectively) pilot phase 2a study in anemic hemodialysis dependent CKD patients commenced in the third quarter of 2017. This study was designed primarily to obtain initial results on the safety, tolerability, and pharmacological activity of 5 once weekly doses of PRS-080, and secondarily to evaluate the effect of repeated PRS-080 administration on hemoglobin levels in this patient population. We completed dosing all patients in the phase 2a study in 2018. We intend to present the full data set from this study in 2019. In February 2017, we signed an exclusive option agreement, or the ASKA Option Agreement, with ASKA Pharmaceutical Co., Ltd., or ASKA, granting them an exclusive option to develop and commercialize PRS-080 in Japan, South Korea and certain other Asian markets (excluding China). We also plan to share the phase 2a data with ASKA, at which point ASKA will decide whether to exercise its option to develop and commercialize PRS-080 in Japan and other Asian territories. Additionally, we plan to share the dataset with others for potential partnerships outside of the ASKA territories.

Strategy

Our goal is to become a fully-integrated biotechnology company by discovering and developing Anticalin-based therapeutics to target validated disease pathways in unique and transformative ways, and to later commercialize our therapeutic products. We intend to engage with partners for many of our programs in a combination of geographic and indication-based arrangements to maximize our business opportunities. We also intend to retain certain development and commercial rights on selected products as our experience in drug development grows. Key elements of our strategy include:

| |

• | Completing PRS-060 phase 1 studies. Our phase 1 SAD study for PRS-060 has been completed, and we initiated a MAD study for PRS-060 in the second half of 2018. This study will evaluate the safety, tolerability and FeNO-reducing potential of PRS-060 versus placebo. Along with our partner AstraZeneca, we anticipate reporting the data from both phase 1 studies at future medical meetings. |

| |

• | Advancing PRS-343 through phase 1 dose escalation first-in-patient study followed by expansion studies and combination regimens in selected HER2 positive tumor patient populations with major unmet needs. We initiated a multicenter phase 1 study with PRS-343 in September 2017, which is ongoing. The study aims to assess safety and tolerability of PRS-343 across a range of HER2-positive tumor types. In addition, a multicenter phase 1 study with PRS-343 in combination with atezolizumab commenced in August 2018, which is also ongoing. The study aims to assess safety and tolerability of PRS-343 in combination with the PD-L1 inhibitor atezolizumab across a range of HER2-positive tumor types. We intend to report comprehensive data from monotherapy study, as well as data from the atezolizumab combination study, in 2019. |

| |

• | Advancing PRS-344 to initiation of phase 1 studies. PRS-344 is currently undergoing IND-enabling activities and we intend to file an IND for the program later in 2019. |

| |

• | Reporting PRS-080 phase 2a study data and pursuing partners who will continue development of the drug candidate. In the fourth quarter of 2018, we dosed the final patient in a phase 2a study of PRS-080 in anemic, hemodialysis-dependent CKD patients. This study is intended primarily to obtain initial results on the safety, tolerability, and pharmacological activity of 5 once-weekly doses of PRS-080 and, secondarily, to evaluate the effect of repeated PRS-080 administration on hemoglobin levels in this patient population. We intend to present the full data set from this study in 2019. We also plan to share these data with ASKA, at which point ASKA will decide whether to exercise its option to develop and commercialize PRS-080 in Japan and other Asian territories. Additionally, we plan to share the dataset with others for potential partnerships outside of the ASKA territories. |

| |

• | Continuing to build our platform by entering into new partnerships and license and collaborative arrangements and advancing our currently partnered programs. We have entered into partnership and collaborative arrangements with pharmaceutical companies in a diverse range of therapeutic areas and geographies. We have active strategic partnerships with the global pharmaceutical companies Servier, AstraZeneca and Seattle Genetics. Together with our |

partners, we intend to advance multiple drug candidates through preclinical studies and to select further drug candidates for clinical development in the future. We will also continue to seek to engage with new pharmaceutical partners that can contribute funding, experience and marketing ability for the successful development and commercialization of our current and future drug candidates.

| |

• | Pursuing additional opportunities for our Anticalin technology. We intend to continue to identify, vet and pursue opportunities to develop novel Anticalin therapeutics for respiratory diseases, oncology and additional diseases. |

Anticalin Platform Technology

Our platform technology focuses on low molecular-weight Anticalin proteins that bind tightly and specifically to a diverse range of targets. Anticalin proteins are derived from human proteins called lipocalins, which are naturally occurring low-molecular weight human proteins of approximately 17 to 21 kDa molecular mass typically found in blood plasma and other bodily fluids. The lipocalin class of proteins defines a group of extracellular specific-binding proteins that, collectively, exhibit extremely high structural homology, yet have a low amino acid sequence identity (less than 20%), making them attractive “templates” for amino acid diversification. Lipocalins naturally bind to, store and transport a wide spectrum of molecules. The defining attributes of the 12-member human lipocalin class and, by extension, Anticalin proteins, engineered from the lipocalin class of proteins, are a rigidly conserved beta-barrel backbone with four flexible loops regions, which, together, form a cup-like binding pocket. The graphic below shows both tear lipocalin (left) and neutrophil gelatinase-associated lipocalin (NGAL, right).

We currently develop our Anticalin proteins from either tear lipocalin, found primarily in human tear fluid as well as the lung epithelium, or NGAL, a protein involved in the innate immune system, by making discreet mutations in the genetic code for the binding regions. These mutations have the potential to lead to highly specific, high-affinity binding for both small and large molecular targets. Mutations are introduced at pre-defined positions, creating exponentially diverse pools of Anticalin proteins, the most potent and well behaved of which are selected and optimized in a customized manner through in vitro selection using techniques such as phage display, a successful technique in antibody-based drug discovery. The ability to generate highly-diverse and high-quality Anticalin libraries and select for the best binders among the large pool of Anticalin proteins by phage display technology gives us the opportunity to select specific and high affine Anticalin proteins for a wide variety of targets. The flexibility inherent in the Anticalin proteins’ cup-like structure allows us to choose both small-molecule targets that can be bound more inside the ‘cup’ as well as larger protein targets that can be bound more by the flexible loop region outside of the 'cup'. Our phase 1a study for PRS-080, our prior phase 1 study of PRS-050, as well as Daiichi's phase 1 study of a PCSK9-specific Anticalin protein, indicate that these proteins may be non-immunogenic and thereby have the potential to exhibit a favorable safety profile.

The below graphic illustrates Anticalin proteins binding to a small molecule (left), a small protein target (hepcidin, center) and a large protein target (CTLA4, right):

To obtain a specific Anticalin protein, we take advantage of the breadth of our proprietary Anticalin libraries, generated through our protein engineering expertise. We have created, and will continue to create, proprietary Anticalin libraries by rationally diversifying the lipocalin regions, thereby generating Anticalin libraries suitable for identifying binders to different types of targets. By utilizing bacterial production from the earliest stages of drug discovery through Current Good Manufacturing Practice, or cGMP, manufacturing, we have created a seamless platform that improves the quality, yield and cost-effectiveness

of our drug candidates comprising of a single Anticalin protein. Anticalin-based bi- and multi- specific drug candidates, such as PRS-343 and PRS-344 are expressed in standard mammalian expression systems. In this way, Anticalin protein manufacturing is not limited to bacterial systems, with the underlying expression system being driven on a program-by-program basis. See “—Manufacturing” below.

Anticalin proteins share many of the favorable qualities of antibodies, including:

| |

• | High specificity to their targets. Like antibodies, Anticalin proteins can bind their targets without binding other molecules, even molecules with very similar chemical structures or amino acid sequences, allowing for more effective treatments through, for example, minimizing off-target effects. |

| |

• | Tight binding and effective biological activity at their targets. Like antibodies, Anticalin proteins are able to bind their targets at subnanomolar affinities. Anticalin proteins can potentially achieve desirable biological effects by inhibiting an undesired or inducing a desired cell activity by binding to cell-surface receptors or their ligands. |

| |

• | Scalability for large-scale production. Like antibodies, Anticalin proteins lend themselves to large-scale production, yet can also be produced in a range of expression systems ranging from prokaryotic (bacterial) to eukaryotic (for example, animal and fungal) cells. Anticalin proteins can take advantage of several well-understood and widely-practiced methods of protein production both in small amounts for preclinical testing and at larger scale for clinical trials and commercial production. |

While often compared to antibodies, we believe Anticalin proteins offer several advantages over antibodies, including:

| |

• | Small size and biophysical stability. Anticalin proteins are small in size and are monomeric. Therefore, we believe Anticalin proteins are generally more stable biophysically than antibodies composed of four polypeptide chains, which will potentially enable unique routes of administration, such as pulmonary delivery. Higher-molecular-weight entities such as antibodies are often too large to be formulated and delivered effectively through these methods. We believe Anticalin proteins will also be less expensive to manufacture than antibodies due to their lower molecular weight and less bulky structure as well as the ability to leverage the prokaryotic-based manufacturing systems, a less costly manufacturing system than mammalian cell-based manufacturing systems, to create them. |

| |

• | Optimization of half-life. Anticalin proteins can be engineered to have a half-life that is optimal for the indication area and a desired dosing schedule. Antibodies typically have half-lives of two weeks or longer, whereas Anticalin proteins can be engineered to have half-lives from hours to weeks, depending on the half-life extension technology employed, if any. This optionality allows us to exert greater control over the amount of circulating Anticalin protein in the blood and the amount of time such Anticalin proteins circulate in the blood, depending on the underlying biology we are trying to address. |

| |

• | Platform for higher-order multispecificity and avoidance of cross-linking. Our Anticalin technology allows for monovalent or multivalent target engagement, including multispecificity within a single protein. We believe that a monovalent “backbone” is an advantage in situations where pure antagonism of certain cellular receptors is desired. The dual-binding nature of antibodies, which have two “arms,” can be a disadvantage in cases when the antibodies bind to and cross-link cell-surface receptors. Such cross-linking often leads to undesirable activation of the cells bearing those receptors. Single-action (monovalent) Anticalin proteins have only a single binding site and by that do not induce cross-linking. Further, when it is called for by the biology we are addressing, we can create multispecific Anticalin proteins that can simultaneously bind (i) two or more different targets or (ii) different epitopes on the same target by genetically linking Anticalin proteins with distinct specificities or by genetic fusion of an Anticalin protein with an antibody. We believe this multispecificity offers advantages in biological settings where binding to multiple targets can enhance the ability of a drug to achieve its desired effects, such as killing cancer cells. Unique Anticalin proteins can be expressed together and undergo simultaneous target engagement as a single fusion protein, without generally compromising on manufacturability. |

| |

• | Flexible formatting facilitates selection of potent T-cell engagers. The molecular architecture of Anticalin proteins as a single polypeptide chain that folds into a stable eight-stranded β-barrel with exposed N- and C-termini, both not part of the binding site, makes them ideal building blocks to generate bispecific and even multispecific fusion proteins offering novel therapeutic modalities. Multispecific Anticalin-based fusion proteins can be used to pursue innovative therapeutic strategies in IO, particularly by addressing the “immunological synapse” that forms at the interface upon contact between an immune cell and a cancer cell. This can drive an efficient activation of tumor-specific T cells in the vicinity of the tumor, thereby avoiding some of the toxicities observed with peripheral T-cell activation in healthy |

tissues. Generally, the formatting flexibility of Anticalin-based biologics offers the ability of modulating valency and geometry of the multispecific compound according to biological needs. For example, Anticalin proteins can be genetically fused to either the N- or C- terminus of the antibody heavy or light chain, thereby resulting in different geometries of the fusion protein with the antibody as well as Anticalin binding sites covering a range of distances with regard to the T cell target on the one hand and the tumor antigen on the other.

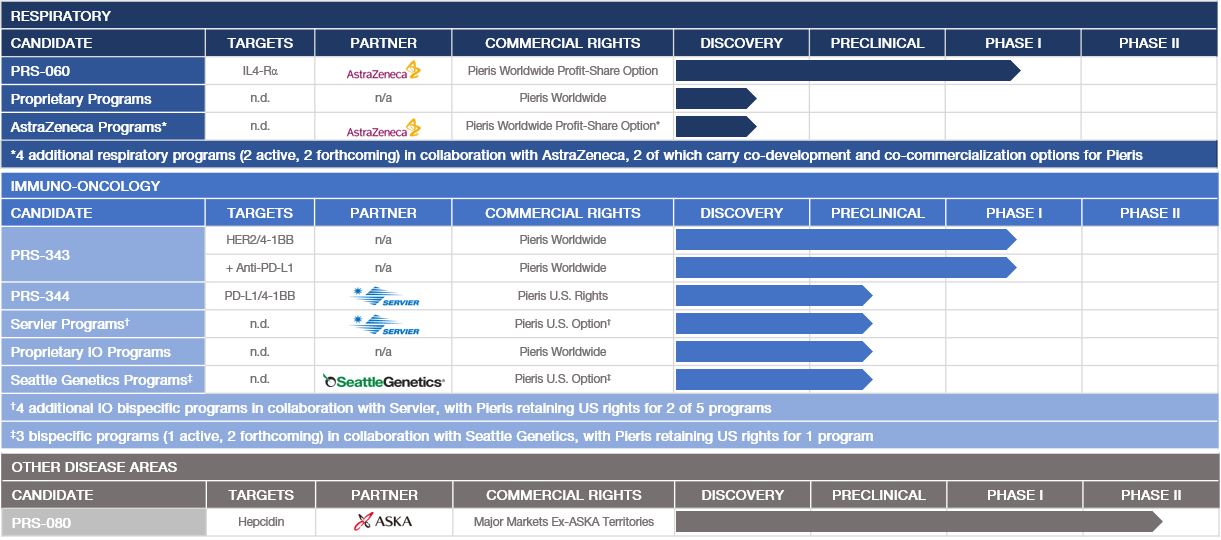

Implementation of the Anticalin Platform Technology: Our Drug Candidate Pipeline

Each of our drug candidates is in the early stage of development, and we anticipate that it will likely be several years before any of our drug candidates could be commercialized. The following table summarizes the status of our current drug candidates and programs:

PRS-060 Targeting IL-4Rα in Asthma

PRS-060 is an Anticalin drug candidate targeting IL-4R, a cell surface receptor expressed on immune cells in the lung. IL-4Rα is specific for the cytokine IL-4 and the closely related cytokine IL-13, both key drivers of the immune system. PRS-060 is derived from human tear lipocalin, has a 20 pM affinity for human IL-4Rα and has a favorable stability profile. Our data showed in vitro that PRS-060 can inhibit the activity of both IL-4 and IL-13. We completed a phase 1 SAD study in healthy volunteers that demonstrated the drug is safe and well tolerated. We initiated a multi-ascending dose phase 1 study in mild asthmatics during the third quarter of 2018. Although the study is primarily designed to establish safety and tolerability, we will also evaluate the drug's potential to reduce FeNO, an established marker of lung airway inflammation. We believe that PRS-060 represents a first-in-class inhaled biologic targeting IL-4Rα for the treatment of asthma. PRS-060 is being developed in partnership with AstraZeneca, as further described below.

Asthma market

Asthma is a very common chronic airway disorder affecting approximately 300 million people worldwide according to the Global Initiative for Asthma and approximately 26 million Americans according to the US Centers for Disease Control. Of these 26 million, approximately 7 million are children. Asthma is responsible for 13 million physician visits per year including approximately 2 million emergency visits in the United States, according to the American Lung Association. In the United States between 2008 and 2013, asthma was responsible for approximately $3 billion in losses due to missed work and school days, approximately $29 billion due to asthma-related deaths, and approximately $50 billion in medical costs. This resulted in a total cost of asthma in the United States of approximately $82 billion in 2013 (Nurmagambetov, Kuwahara and Garbe, Annals of the American Thoracic Society, http://www.atsjournals.org/doi/pdf/10.1513/AnnalsATS.201703-259OC, Volume 15, No. 3, pp 348-356, March 2018).

In 2016, of the approximately 19 million asthma patients over 12 years of age in the United States, about 41%, or 7.8 million, had moderate-to-severe asthma; of the approximately 47.8 million asthma patients over 12 years of age in Europe, about 45%, or 21.5 million, had moderate-to-severe asthma. About 40% of moderate-to-severe asthma patients have uncontrolled asthma, which amounts to approximately 3.1 million patients with moderate-to-severe uncontrolled asthma in the United States and

approximately 8.6 million in Europe (Artisan Healthcare Consulting analysis, including the following: CDC, Eurostat, Rabe (2004), Cazzoletti (2007), Colice (2012), Hekking (2015)). There are several biologics approved for moderate-to-severe uncontrolled asthma in the United States and Europe. Omalizumab is an anti-IgE monoclonal antibody marketed by Roche/Genentech for moderate-to-severe persistent allergic asthma and chronic idiopathic urticaria; in 2018, Roche/Genentech reported total global sales for omalizumab in the amount of CHF 1,912 million ($1,905 million). Mepolizumab is an anti-IL5 monoclonal antibody marketed by GlaxoSmithKline, or GSK, for severe eosinophilic asthma; in 2018, GSK reported global sales for mepolizumab in the amount of £563 million ($727 million). Benralizumab is an anti-IL5 receptor monoclonal antibody marketed by AstraZeneca for severe eosinophilic asthma; in 2018 AstraZeneca reported global sales for benralizumab in the amount of $297 million. Dupilumab is an anti-IL4Rα monoclonal antibody marketed by Sanofi/Regeneron for atopic dermatitis and moderate-to-severe uncontrolled asthma; in 2018, Sanofi/Regeneron reported total global sales of dupilumab in the amount of $922 million.

Challenges in using conventional therapy

The current standard of care for persistent, moderate-to-severe allergic asthma is high-dose inhaled corticosteroids or ICS often in combination with inhaled long-acting beta-adrenergic agonists, or LABA. In uncontrolled moderate-to-severe allergic asthma, omalizumab is given to patients in addition to ICS/LABA combinations. Omalizumab was approved for this condition in the United States in 2003. Outside of the United States, omalizumab is approved for severe asthma. Omalizumab works by binding to the immune mediator immunoglobulin E, or IgE, and inhibiting IgE-mediated activation of mast cells and basophils, types of white blood cells. It has also been shown to impact some diseases, such as asthma, which are driven by eosinophils, another important class of immune cells. However, patient response to omalizumab has shown to be inconsistent, as reported in a publication by McNicholl and Heaney in 2008 in the journal Core Evidence, which explained that in only some studies did omalizumab improve lung function. Furthermore, general asthma symptoms are also typically unaffected by omalizumab. Finally, in 2007, the US Food and Drug Administration, or the FDA, issued a black box warning for omalizumab due to reported cases of anaphylaxis, a potentially life-threatening allergic reaction suffered by some patients who had taken the drug.

Beyond omalizumab, there are four approved biologics for the treatment of asthma. Three target the IL-5 pathway and one targets IL-4Rα. GSK's, mepolizumab, which targets IL-5, was approved for severe eosinophilic asthma in adults and children older than 12 in 2015. Teva’s reslizumab, also targeting IL-5, was approved in 2016 and AstraZeneca’s benralizumab, which targets IL-5 receptor alpha, or IL-5Rα, was approved in November 2017.

Dupilumab is an antibody that targets IL-4Rα that is delivered subcutaneously and was approved for the treatment of moderate to severe atopic dermatitis in March 2017. In October 2018, Regeneron and its partner Sanofi announced that the FDA had approved dupilumab as "add-on maintenance therapy in patients with moderate-to-severe asthma aged 12 years and older with an eosinophilic phenotype or with oral corticosteroid-dependent asthma." In the phase 3 Liberty Asthma Quest study, dupilumab (300mg every 2 weeks) in the pre-specified high eosinophilic group (eosinophil blood count of ≥ 300 cells/microliter) demonstrated a reduction in annualized rate of severe exacerbations by 67.4% and an improvement in forced expiratory volume in one second, or FEV1, by 0.24L. The Liberty Asthma Venture trial evaluated dupilumab in oral glucocorticoid dependent severe asthma patients. In the overall population, the percentage of patients that decreased oral corticosteroid use by 50% or more was 80% in the dupilumab group versus 50% for placebo (or a 60% relative reduction), while decreasing the rate of severe exacerbations by 59% and improving FEV1 by 0.22L versus placebo. In the high eosinophilic group, dupilumab decreased the rate of severe exacerbations by 71% and improved FEV1 by 0.32L versus placebo (Rabe et al., 2018).

Advantages to inhalation as a route of administration for PRS-060

PRS-060 was safe and well-tolerated in SAD phase 1 study. The drug candidate is currently being evaluated in a MAD phase 1 study. We believe that local delivery via inhalation may lead to a better tolerability profile than systemically administered antibodies. Since dosing by inhalation is a common route of administration in asthma patients, it could represent a more convenient dosage regimen for patients than dosing of antibodies by injection.

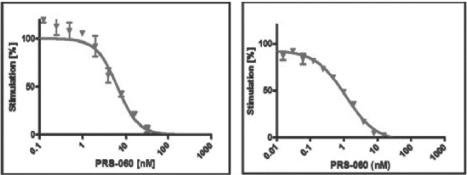

Preclinical data

In in vitro assays, PRS-060 specifically bound to immobilized targets such as human IL-4Rα in a concentration-dependent manner. We tested the binding of PRS-060 to various targets in an enzyme-linked immunosorbent assay, or ELISA, a standard in vitro assay platform. In these tests, PRS-060 bound to IL-4Rα with subnanomolar affinity and it did not bind to three other human cell-surface interleukin receptors (IL-6R, IL-18Rα, IL-23Rα). Furthermore, the activity of IL-4 and IL-13 was inhibited

by PRS-060 in a dose-dependent manner. The charts below show the inhibition of IL-4- (left) or IL-13- (right) induced proliferation in human TF-1 cells in vitro by PRS-060.

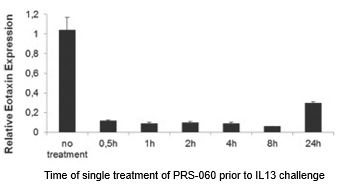

In in vivo assays in mice genetically altered to express human IL-4Rα, human IL-4 and IL-13, low doses of PRS-060 inhibited the induction of eotaxin protein, a marker of airway inflammation, in lung tissue following pulmonary delivery. We observed this inhibition at both the RNA and protein levels compared both to buffer and to tear lipocalin (control).

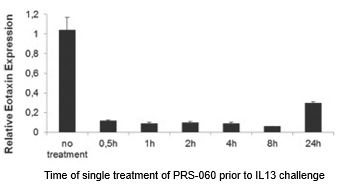

The chart below shows the duration of PRS-060-mediated inhibition of eotaxin gene expression, a marker of airway inflammation, in lung tissue by a single pulmonary dose in mice:

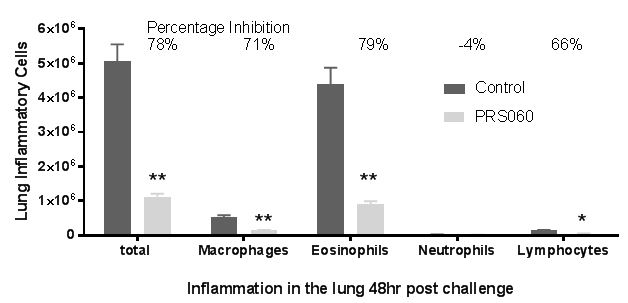

When we administered IL-13 into the lung of humanized mice (that express human IL-4, IL-13 and IL-4Rα), inflammation was induced as determined by eotaxin expression, which was not inhibited when phosphate buffered saline, or PBS, or human wild type lipocalin was administered into the lung. In contrast to the PBS administration, increases in eotaxin expression were prevented when PRS-060 was administered into the lung before IL-13. As demonstrated in the above chart, the model showed the inhibitory potential lasts for up to 24 hours after PRS-060 administration. We have also demonstrated that PRS-060 reduces the inflammation associated with antigen challenge in a mouse asthma model. The chart below shows that pre-treatment with PRS-060 reduces the lung levels of the key inflammatory cells' eosinophils and lymphocytes, a profile that supports the hypothesis that lung delivery of an IL-4Rα antagonist to asthmatics may be viable approach to the treatment of asthma.

Clinical data

In November 2018, we disclosed that PRS-060 was safe and well tolerated in the SAD, healthy volunteer, phase 1 study. A MAD phase 1 study is currently enrolling mild asthmatics with elevated levels of FeNO (>35 ppb), testing the safety and tolerability of PRS-060 administered twice daily for 9 days and once on a final, 10th day. In addition, the MAD study will evaluate the FeNO-lowering potential of PRS-060 versus placebo. We plan to disclose data from both studies at upcoming medical meetings.

Proprietary Respiratory Platform

We are developing a proprietary Anticalin protein pipeline for asthma and other respiratory diseases via inhaled administration. The company initiated two new programs directed to discovering and developing Anticalin proteins for respiratory diseases during 2018.

AstraZeneca Respiratory Collaboration Beyond PRS-060

Our license and collaboration agreement with AstraZeneca, or the AstraZeneca Collaboration Agreement, includes four programs beyond PRS-060. We retain co-development and co-commercialization rights to two out of those four programs. We have initiated discovery work on the first two additional development candidates under the collaboration. The targets and disease areas of those two programs are undisclosed.

PRS-343 Targeting 4-1BB (CD-137) in Oncology

PRS-343 is a bispecific protein targeting the immune receptor 4-1BB and the tumor target HER2. It is generated by genetic fusion of an Anticalin protein specific for 4-1BB to each heavy chain of a variant of a HER2-targeting antibody. The mode of action of this 4-1BB/HER2 bispecific is to promote 4-1BB clustering by bridging 4-1BB-positive T cells with HER2-positive tumor cells, and to thereby provide a potent costimulatory signal to tumor antigen-specific T cells. PRS-343 is intended to localize 4-1BB activation in the tumor, and to thereby both increase efficacy and reduce systemic toxicity compared to 4-1BB-targeting antibodies being developed by third parties in clinical trials. We initiated a phase 1 dose-escalation study of PRS-343 in HER2 positive patients in September 2017 and a phase 1 dose-escalation study of PRS-343 in combination with atezolizumab in HER2 positive patients in August 2018. We intend to report comprehensive data from the monotherapy study, as well as data from the combination study, in 2019.

Biology of the costimulatory immune receptor 4-1BB

4-1BB, is a co-stimulatory immune receptor and a member of the tumor necrosis factor receptor, or TNFR, super-family. It is mainly expressed on activated CD4+ and CD8+ T cells, activated B cells, and natural killer, or NK, cells. 4-1BB plays an important role in the regulation of immune responses and thus is a target for cancer immunotherapy. 4-1BB ligand, or 4-1BBL, is the only known natural ligand of 4-1BB and is constitutively expressed on several types of antigen-presenting cells, or APC. 4-1BB-positive T cells are activated by engaging a 4-1BBL-positive cell. The induced 4-1BB clustering leads to activation of the receptor and downstream signaling. In a T cell pre-stimulated by the T cell receptor, or TCR, binding to a cognate major histocompatibility complex, or MHC, target, costimulation via 4-1BB leads to further enhanced activation, survival and proliferation, as well as the production of pro-inflammatory cytokines and an improved capacity to kill.

Validation of 4-1BB as a therapeutic target in cancer

The benefit of 4-1BB costimulation for the elimination of cancerous tumors has been demonstrated in a number of murine in vivo models. The forced expression of 4-1BBL on a tumor, for example, leads to tumor rejection. Likewise, the forced expression of an anti-4-1BB single chain antibody fragment, or scFv, on a tumor leads to a CD4+ T cell and NK-cell dependent elimination of the tumor. A systemically administered anti-4-1BB antibody has also been demonstrated to lead to retardation of tumor growth.

Human ex vivo data support the potential of 4-1BB as a costimulatory receptor in cancer therapy: It has been reported that for T cells isolated from human tumors, 4-1BB is an effective marker for those that are tumor-reactive. Based on this observation, we believe that anti-4-1BB antibodies can be utilized to improve adoptive T cell therapy, or ACT, by augmenting the expansion and activity of CD8+ melanoma tumor-infiltrating lymphocytes, or TILs.

Finally, the potential of 4-1BB targeting has also been shown in nonclinical combination therapy studies, where an additional benefit was demonstrated by combination of 4-1BB agonism with checkpoint blockade or NK cell-targeting antibodies.

Current approaches to clinical 4-1BB targeting

The demonstration of the potential therapeutic benefit of 4-1BB costimulation in nonclinical models has spurred the development of therapeutic antibodies targeting 4-1BB, utomilumab and urelumab.

Utomilumab is a fully humanized IgG2 antibody that binds 4-1BB in a manner that blocks the binding of endogenous 4-1BBL to 4-1BB, and that according to publicly available data is well tolerated as a monotherapy and in combination with rituximab.

Urelumab is an IgG4 antibody that, in contrast to utomilumab, binds 4-1BB in a manner that does not interfere with the 4-1BB / 4-1BBL interaction. While an initial study reported manageable toxicity with doses up to 10mg/kg, a follow-up monotherapy phase 2 study was reported to have been stopped due to an “unusually high incidence of grade 4 hepatitis.” Prior clinical trials with urelumab were focused on safety and efficacy at lower doses as monotherapy or in combination, for example, with rituximab (NCT01775631).

Rationale for bispecific targeting of 4-1BB

We believe that the natural mode of activation of 4-1BB, which requires receptor clustering, demonstrates that an ideal 4-1BB-targeting agent should firstly lead to clustering of 4-1BB, and secondly do so in a tumor-localized fashion on TILs. The antibodies currently in clinical development are not ideal in that respect, as 4-1BB clustering can only be induced by binding to Fcg receptor-positive cells, which are not selectively tumor-localized but distributed throughout the body for Fcg-dependence of TNFR targeting. The toxicity data of urelumab indicates that such a non-selective activation leads to unacceptable toxicity, potentially making it impossible to find a therapeutic window for such 4-1BB-targeting antibodies.

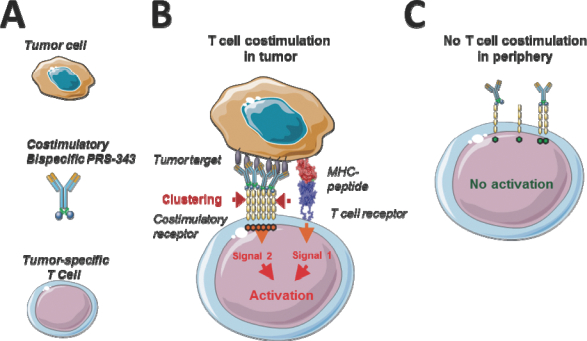

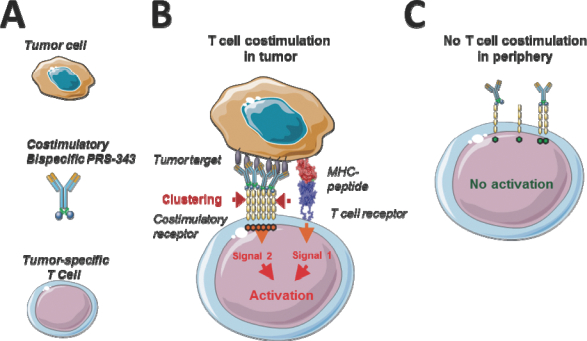

We therefore hypothesized that to obtain an ideal 4-1BB-targeting agent, a bispecific molecule should be designed that targets 4-1BB on one end and a differentially expressed tumor target on the other end. A visualization of the general concept is provided in Figure 1, below. HER2/4-1BB bispecific is envisioned to promote 4-1BB clustering by bridging T cells with HER2-positive tumor cells, and to thereby provide a potent costimulatory signal to tumor antigen-specific T cells, further enhancing its TCR-mediated activity and leading to tumor destruction.

|

| |

Figure 1 | Concept of costimulatory T cell engagement. (A) The elements of the system are a target-positive tumor cell, a T cell with a TCR that is specific for an HLA/peptide combination on the tumor, and a costimulatory bispecific. (B) Within a patient´s tumor, tumor-specific T cells are bridged with tumor cells by a costimulatory bispecific. The resulting clustering of the costimulatory TCR provides a local co-activating signal to the T cell, further enhancing its TCR-mediated activity and leading to tumor destruction. (C) Toxic side effects are expected to be manageable, as target-negative cells do not lead to costimulation of T cells due to a lack of target-mediated receptor clustering, and healthy tissue is spared by tumor-costimulated T cells due to the absence of a primary, TCR-mediated signal. Design and Generation of HER2/4-1BB bispecific PRS-343. |

To obtain a molecule that would work by the mode of action of costimulatory T-cell engagement, we generated the HER2/4-1BB bispecific PRS-343. The molecule consists of two different building blocks binding to the two targets HER2 and 4-1BB. To generate the 4-1BB-specific building block of PRS-343, we utilized Anticalin technology. A 4-1BB-binding Anticalin protein was generated based on a re-design of the natural binding pocket of NGAL using mutant Anticalin libraries and a selection and screening process. The lead 4-1BB-binding Anticalin protein binds human 4-1BB with an affinity of 2 nM as determined by surface plasmon resonance, or SPR, and is capable of costimulating human T cells when immobilized on a plastic dish together with an anti-CD3 antibody.

To generate the bivalent HER2/4-1BB bispecific PRS-343, we constructed a genetic fusion of a 4-1BB-specific Anticalin protein to the C-terminus of each heavy chain of the trastuzumab IgG4 variant, connected by a flexible, non-immunogenic 15 amino acid linker sequence.

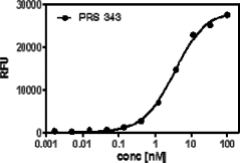

We utilized a Sandwich ELISA experiment to investigate whether PRS-343 can bind both targets at the same time, which is a necessary prerequisite for the envisioned mode of action of PRS-343. Figure below shows that a sigmoid binding curve results from this titration, proving that both targets can indeed be engaged at the same time, fulfilling the key requirement for simultaneous costimulatory engagement of T cells by HER2-positive target cells.

|

| |

Figure 2 | PRS-343 simultaneous binding to targets HER2 and 4-1BB. Recombinant Her2 was coated on a microtiter plate, followed by titration of PRS-343. Subsequently, a constant concentration of biotinylated human 4-1BB was added, which was detected via a peroxidase-conjugated avidin variant. |

Mode of action – costimulatory T cell activation

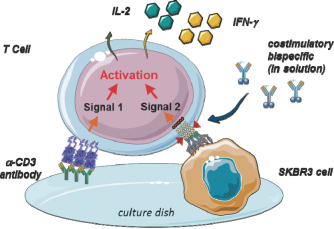

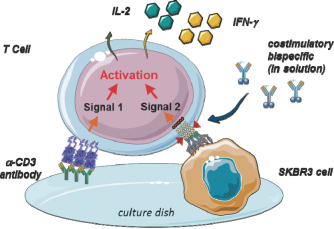

We developed a novel T cell activation assay format to investigate whether PRS-343 is capable of costimulating T cells that have received a basic stimulus via the TCR. The assay, visualized in Figure 3 below, is based upon providing the TCR stimulus via an anti-CD3 antibody coated onto the plastic culture dish, while 4-1BB costimulation is achieved by tumor-target dependent clustering of 4-1BB on purified T cells.

|

| |

Figure 3 | Visualization of costimulatory T cell activation assay. HER2-positive tumor cells are grown overnight on cell culture plates that have been precoated with low amounts of an anti-CD3 antibody to provide a limited primary activation of T cells via the T cell receptor. T cells are added to the wells together with the titrated 4-1BB/HER2 bispecific PRS-343, leading to clustering of the costimulatory 4-1BB receptor, which in turn results in T-cell costimulation. T cell costimulation is detected by increased supernatant IL-2 and IFN-γ levels in the culture supernatants after continued culture. |

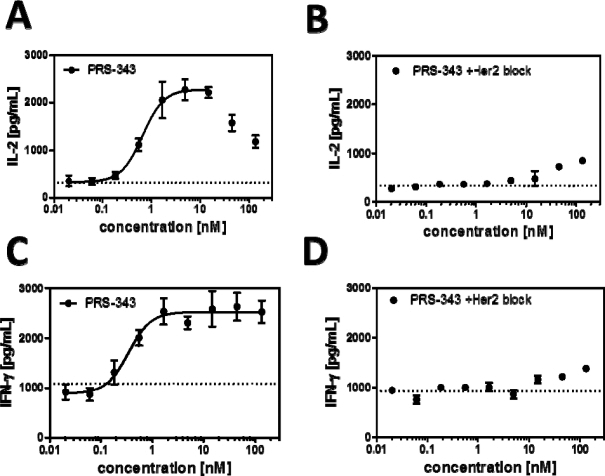

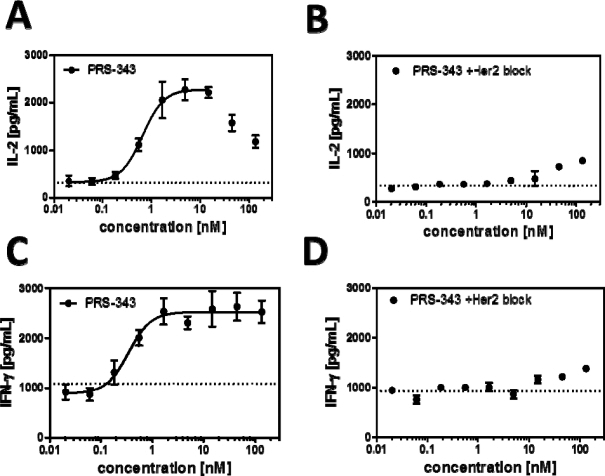

There is a clear induction of IL-2 (Figure A) and IFN-γ (Figure C) with increasing concentrations of PRS-343. The fitted EC50 of this effect is similar for both proinflammatory cytokines, with 0.7 nM for IL-2 induction and 0.3 nM for IFN-α induction, respectively. That T-cell costimulation is indeed, due to the bispecific engagement of T cells and SKBR3 cells, shown by two observations: firstly, the monospecific antibody trastuzumab does not lead to enhanced T cell activation (average shown as dotted line in Figure A and Figure C), and secondly, disrupting the bispecific interaction with an excess of trastuzumab abolishes the effect of IL-2 and INF-γ induction almost completely, except at the highest concentrations of PRS-343 employed (Figure B and Figure D).

|

| |

Figure 4 | Experimental result of costimulatory T cell activation assay. HER2-positive SKBR3 tumor cells were grown overnight on 96-well plates that had been precoated with 0.25 µg/mL anti-CD3 antibody for 1 h at 37°C. The next day, T cells purified from healthy donor PBMC were added to the wells together with the titrated 4-1BB/HER2 bispecific PRS-343 (filled circle) or trastuzumab as a control (dotted line). After three days in culture, IL-2 (A) and IFN-γ, levels in the culture supernatants were measured by an electrochemoluminescence immunoassay. In parallel, the experiment was performed in the presence of an excess of trastuzumab (340 nM) to inhibit the binding of PRS-343 to the SKBR3 cells, and IL-2 (C) and IFN-γ (D) levels were measured. |

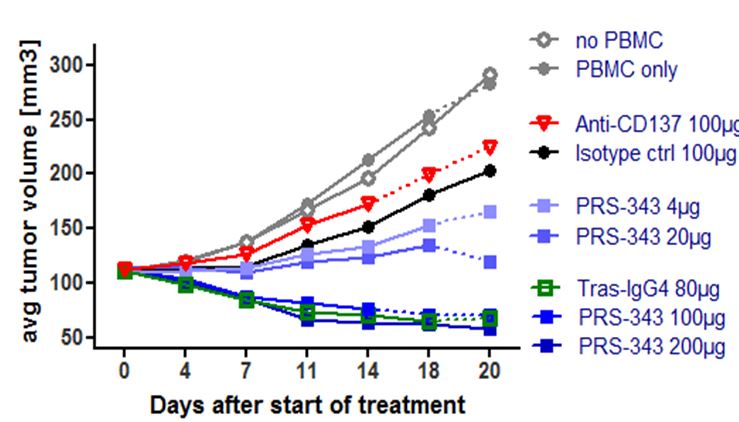

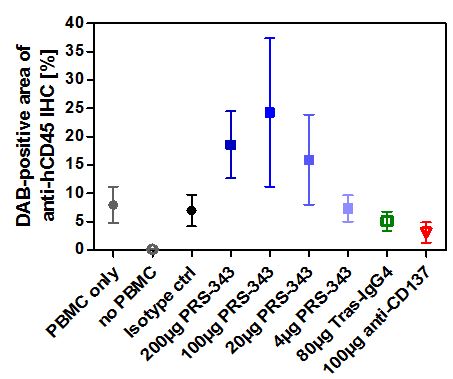

Proof of concept data utilizing a humanized SK-OV-3 mouse model demonstrated dose-dependent tumor growth inhibition compared to treatment with the isotype control (Figure 5). It is anticipated that the tumor growth inhibition, or TGI, in this model is predominantly caused by the anti-HER2. The anti-tumor response observed with PRS-343 was accompanied by a significantly higher tumor infiltration with human lymphocytes (hCD45+). Interestingly, the anti-4-1BB benchmark neither displayed tumor growth inhibition nor enhanced lymphocyte infiltration into tumors compared to isotype. The tras-IgG4 control was also devoid of lymphocyte infiltration into the tumor but displayed a tumor growth inhibition comparable to PRS-343. Taken together, these data show that PRS-343 provided dual activity by both increasing the frequency of TILs by bispecific targeting of CD137 and HER2 as well as mediating direct tumor growth inhibition by the direct, monospecific targeting of HER2.

|

| |

Figure 5 | PRS-343 activity in NOG mice engrafted with HER2-positive SK-OV-3 cell line and human PBMC. (A) Median of tumor growth. (B) Frequency of CD45+ cells determined by immunohistochemistry of tumors after study end. |

PRS-344

PRS-344 consists of a PD-L1 targeting antibody and 4-1BB targeting Anticalin proteins genetically fused to each arm of the C-terminal heavy chain of the antibody. The Anticalin moiety of PRS-344 is a single domain protein based on the extracellular human protein NGAL that has been engineered to bind 4-1BB with high affinity and selectivity.

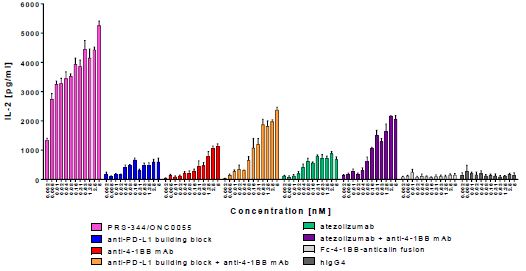

4-1BB is a costimulatory receptor belonging to the TNFR super-family. Clustering of 4-1BB on the surface of T cells leads to T cell activation, proliferation and cytokines secretion. The mode of action of PRS-344 is to promote 4-1BB clustering by bridging 4-1BB-positive T cells with PD-L1-positive tumor cells, and to thereby provide a potent costimulatory signal to tumor antigen-specific T cells. PRS-344 is intended to localize 4-1BB activation in the tumor in a PD-L1 dependent manner. PD-L1 is a transmembrane protein belonging to the B7 family and is expressed on a variety of cells including T cells, B cells, epithelial and vascular endothelial cells. Most importantly, PD-L1 is found at high levels on tumor cells of several cancer types including but not limited to melanoma, lung, bladder, colon, and breast cancer. Binding of PD-L1 to its receptor PD-1 leads to exhaustion of tumor-infiltrating T cells. PRS-344 blocks the PD-1/PD-L1 interaction and thus is capable of reversing T-cell exhaustion in the tumor microenvironment. Preclinical data shows that the synergistic effect observed by targeting PD-L1 and 4-1BB simultaneously is stronger with PRS-344 than with the combination of anti-PD-L1 and anti-4-1BB antibodies.

|

| |

Figure 1 | The combination of atezolizumab and anti-4-1BB benchmark demonstrates the strong synergistic effect of T cell costimulation and checkpoint blockade in T cell activation. With PRS-344, this synergistic effect is massively increased. |

Together with our partner Servier, we plan to initiate a phase 1 study of PRS-344 in the second half of 2019. This first-in-human study will consist in evaluating the safety and tolerability profile of PRS-344 and determining its maximum tolerated dose, or MTD, and/or the recommended phase 2 dose, or RP2D, in patients with solid tumors. In addition, the PK profile as well as pharmacodynamic effects of the PRS-344 will be characterized in the study. Any initial signs of anti-tumoral activity will be correlated to safety and PK and further explored in expansion cohorts.

IO Market with respect to PRS-343 and PRS-344

In 2018 there were approximately 1.735 million estimated new cancer cases in the United States (NCI Surveillance, Epidemiology, and End Results Program) and approximately 18.1 million cancer cases worldwide (IARC GLOBOCAN 2018). The direct medical cost for cancer in the United States in 2015 was estimated to be approximately $80.2 billion by the Agency for Healthcare research and Quality, or the AHRQ.

Checkpoint inhibitors such as PD-1 and CTLA4 have revolutionized the way certain cancers are treated and in 2018 the Noble Prize in Medicine was awarded to Dr. James Allison and Dr. Tasuku Honjo for their discovery of CTLA-4 and PD-1, respectively. By the end of 2018 a total of six anti-PD-1 or PD-L1 monoclonal antibodies and one anti-CTLA4 antibody have been approved in the United States. Global sales in 2018 for these seven checkpoint inhibitors exceeded $16 billion. The majority of the global sales of checkpoint inhibitors comes from two anti-PD-1 monoclonal antibodies: pembrolizumab marketed by Merck & Co and nivolumab marketed by Bristol-Myers Squibb. In 20187, Merck & Co reported sales of $7.171 billion for pembrolizumab and Bristol-Myers Squibb reported $6.735 billion for nivolumab.

Other IO Programs

Current antibody-based therapies targeting tumor cell destruction or immune activation are hampered by, among other factors, low response rates and the induction of immune-related adverse events. Our IO pipeline beyond PRS-343 and PRS-344 is designed to target checkpoint proteins or, like PRS-343, costimulatory proteins. These programs consist of a variety of multifunctional biotherapeutics that can encompass a fusion of antibodies with Anticalin proteins or two or more Anticalin proteins to each other. These combined molecules have the potential to build upon current therapies by modifying or regulating one or more immune functions on a single fusion protein, thereby having the potential to elevate immune responses within a tumor microenvironment. We believe that a tethered Anticalin protein directed at checkpoint or co-stimulatory targets can preferentially activate the immune system at the site of the tumor microenvironment thus providing efficacy with enhanced therapeutic index. We believe that these bispecific constructs represent a “platform within a product” opportunity in IO since it may be possible to apply a single combined Anticalin-antibody molecule in a number of different cancers. This belief is based on the shared underlying biology such as checkpoint and costimulatory biology found within tumors arising in different organs.

Servier Collaboration Beyond PRS-344

Our Servier Collaboration Agreement includes four programs beyond PRS-344. We retain co-development and co-commercialization rights to two out of those four programs. The four additional programs have been defined, which may combine antibodies with one or more Anticalin proteins based on our proprietary platform to generate innovative immuno-oncology bispecific drug candidates.

Seattle Genetics Collaboration

Our collaboration with Seattle Genetics to discover and develop Anticalin-based tumor-targeted bispecific therapeutics in IO includes up to three programs. We retain a co-development and co-commercialization option for one of these three programs.

PRS-080 Targeting Hepcidin in CKD-related FID-anemia

PRS-080 is an Anticalin drug candidate targeting hepcidin, a peptide mediator that is an important negative regulator of iron absorption and storage, derived from the naturally occurring human lipocalin known as NGAL. The normal function of hepcidin is to maintain equilibrium in iron supply for red blood cell production by binding to ferroportin, or FPN, the protein that transports iron from the inside of a cell to the outside, inducing its internalization and subsequent degradation. The binding of hepcidin to FPN reduces the iron uptake from the intestine into the body and inhibits iron mobilization from cellular stores into red blood cells. An excess amount of hepcidin can cause FID, which often cannot be treated adequately with iron supplements and can lead to anemia. According to a 2009 publication by Young and Zaritsky in the Clinical Journal of the American Society of Nephrology, lowering hepcidin levels or antagonizing its actions would reverse the negative effects of inflammation on red blood cell formation by allowing mobilization of stored iron and improved iron absorption.

PRS-080 has been designed to target hepcidin for the treatment of FID in anemic patients with CKD, particularly in ESRD patients requiring dialysis, to allow them to mobilize iron that is trapped in iron storage cells for use in the creation of red blood cells. We have also engineered PRS-080 to have a half-life of less than a week, so that following administration, it is expected to clear from the human body in a much shorter timeframe than antibodies, which typically have a half-life of two weeks or greater. This half-life was achieved by covalently linking PRS-080 to a specific PEG in order to extend the serum half-life of the combined molecule to desirable levels. Since hepcidin is constantly produced by the body, we believe that a frequent, for example, once per week, dosing interval will be optimally suited to interfere with hepcidin function. A shorter half-life than antibodies may be more compatible with this dosing schedule. A longer antibody-like residence time is not seen as advantageous, but rather could lead to the accumulation of both the drug and the target beyond the typical residence time of hepcidin, resulting in large quantities of hepcidin bound to antibodies. We completed a phase 1a SAD study with PRS-080 in healthy volunteers in 2015. Results from this study were presented at the 2015 Annual Conference of the American Society of Hematology (http://www.bloodjournal.org/content/126/23/536). Based on the data obtained, we initiated a phase 1b study in stage 5 CKD patients requiring hemodialysis which we completed in February 2017. We initiated a multi-dose clinical study in CKD patients requiring hemodialysis in the third quarter of 2017, which is assessing the safety and tolerability of multi-dose administration of PRS-080, as well as a secondary assessment of repeated doses of PRS-080 on hemoglobin levels over a period of approximately one month. The final patient was dosed in this phase 2a study in 2018 and we intend to report the results of this study in 2019.

Anemia and FID in the CKD population

Anemia is a serious medical condition in which blood is deficient in red blood cells and hemoglobin, leading to inadequate oxygen delivery to tissues and cells throughout the body. Anemia is generally said to exist when hemoglobin is less than 13 g/dL in men and 12 g/dL in women. Anemia has a number of potential causes, including nutritional deficiencies, iron deficiency, bone marrow disease, medications, and abnormalities in production of or sensitivity to erythropoietin, a hormone that controls red blood cell production. Anemia is a frequent and severe consequence of CKD. In addition, within the CKD population, anemia may be caused by FID. FID exists when, despite adequate stores, iron cannot be mobilized for erythropoiesis. In this case, despite treatment with exogenous erythropoietin and iron supplements, “functional” iron is still deficient. FID-anemic patients can be identified and selected for therapy using marketed laboratory tests for iron metabolism. According to the results of a 2017 research analysis conducted for us by Artisan Healthcare Consulting, there were an estimated 505,000 individuals with ESRD that were on hemodialysis in the US in 2017 and approximately 90% of these patients are treated with erythropoiesis stimulating agents, or ESAs. Up to 50% of the ESRD patients on hemodialysis that are currently treated with ESA have FID. Approximately 15% of the FID patients are still anemic despite ESA treatment. Based on the estimated 505,000 individuals with ESRD on hemodialysis, we believe that approximately 34,000 individuals are FID-anemic despite ESA treatment in the US.

Challenges in using conventional therapy

We believe that CKD patients with FID-anemia are especially poorly served. These patients have adequate stores of iron but this iron is not efficiently incorporated into red blood cell precursors through recombinant erythropoiesis stimulating agents, or rESAs, and iron supplements. According to the 2009 publication by Young and Zaritsky in the Clinical Journal of the American Society of Nephrology, this imbalance in iron metabolism is a result of a high level of circulating hepcidin in the blood stream. We believe that existing therapies are limited in that they do not have an impact on hepcidin or, in the case of rESAs, patients often become resistant to the therapy.

Our potential solution: binding hepcidin with PRS-080

We have engineered PRS-080 so that it binds to hepcidin and reduces the impact of hepcidin’s negative regulation on iron mobilization. We believe that by blocking the actions of hepcidin, PRS-080 may address anemia by mobilizing iron for incorporation into red blood cells.

In patients suffering from anemia of CKD, and specifically in patients with FID, hepcidin is chronically produced by the body in abnormally large amounts. Therefore, we believe that the best way to inhibit its function is to administer an inhibitor on a repeated basis, such as once a week. Our approach will use PRS-080 in connection with a conjugated PEG30 molecule, a well-known half-life extender, in order to allow the drug sufficient residence time in the body. Once coupled to PEG30, PRS-080 is intended to have a half-life that will be optimally suited for dosing anemic patients with CKD. In contrast, antibodies typically have a half-life of two to three weeks. Such a long half-life renders antibodies unsuitable for frequent administration and elimination of a circulating target protein like hepcidin because such antibodies tend to accumulate the target after binding due to their own long residence time in the body with the associated risk of bound hepcidin being released by antibodies that are still circulating in the blood.

Preclinical data

Hepcidin binds to FPN and induces its internalization and subsequent degradation, thus disabling iron mobilization from cells. PRS-080 binds strongly to hepcidin and inhibits its activity in a dose dependent manner as shown in in vitro potency assays. PRS-080 is able to completely inhibit the internalization of FPN above a concentration of 20 nM.

Our preclinical studies targeted the cynomolgus monkey orthologue of hepcidin, which has a high degree of similarity (96% identity) with human hepcidin. PRS-080 was found to bind with high affinity to the cynomolgus monkey version of hepcidin.

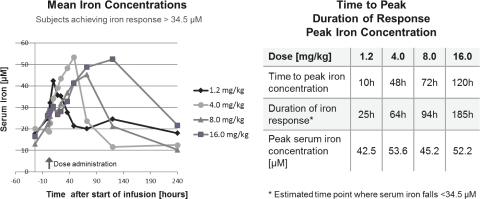

We performed a dose finding study in cynomolgus monkeys, testing intravenous 30-minute infusions as well as subcutaneous injections of PRS-080 to study the PK properties of PRS-080 and the functional consequences of hepcidin inhibition on iron mobilization. A dose of 1 mg/kg PRS-080 produced a robust, transient and reversible increase in total iron levels from approximately 36 µM at baseline to 52 µM after 8 hours. Doses higher than 1 mg/kg elevated serum iron concentrations to comparable levels and, in a dose-dependent manner, prolonged the response. A linear correlation was observed over time between the PRS-080 dose increases and the increase of serum iron concentrations. The PK properties of PRS-080 were investigated after a single administration at doses ranging from 20 mg/kg to 150 mg/kg. The concentration over time profiles of PRS-080 showed standard drug-like properties, as the kinetics were dose proportional and there was a low volume of distribution. Elimination of PRS-080 occurred with a terminal half-life of about 2 days, which suggests a 3-day half-life in humans.

We also carried out a 4-week repeated dose toxicology study with intravenous infusions of PRS-080 for 30 minutes every other day. Our work included toxicokinetic and anti-drug antibody, or ADA, measurements. During the study, safety pharmacology parameters on the cardiovascular system and respiration were monitored and all safety endpoints were met. Our preclinical studies also examined a different NGAL-derived Anticalin, or surrogate molecule, which targets rat hepcidin in a rat model of inflammation-induced anemia. In these studies, administration of the surrogate molecule once per day or every other day inhibited the manifestation of anemia in the rats over the course of a three-week period.

The 4-week repeated PRS-080 dosing to cynomolgus monkeys was well tolerated up to the highest tested dose of 120 mg/kg. This dose was classified as producing no AEs as a result of the fact that routine laboratory tests and blood cell examinations did not demonstrate any adverse findings and safety pharmacology investigations were also without AEs. As a result of the hepcidin inhibition, the study showed increased iron uptake and storage, for example in the liver, and mobilization.

The functional consequence of PRS-080 treatment on bone marrow activity and red blood cell production, or hematopoiesis, by means of hemoglobin (an oxygen transporting protein contained in red blood cells) concentration in reticulocytes, a precursor of red blood cells, was investigated in cynomolgus monkeys following repeated administration. As shown in the below chart, after administration of PRS-080 either intravenously (i.v. 150 mg/kg) or subcutaneously (s.c. 20 mg/kg), elevated hemoglobin concentrations in reticulocytes, or Retic CH, were observed on day 30 compared to pre-treatment (pre-dose).

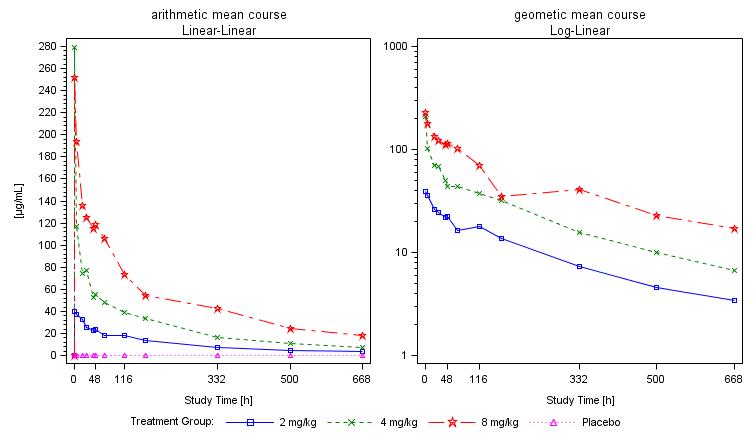

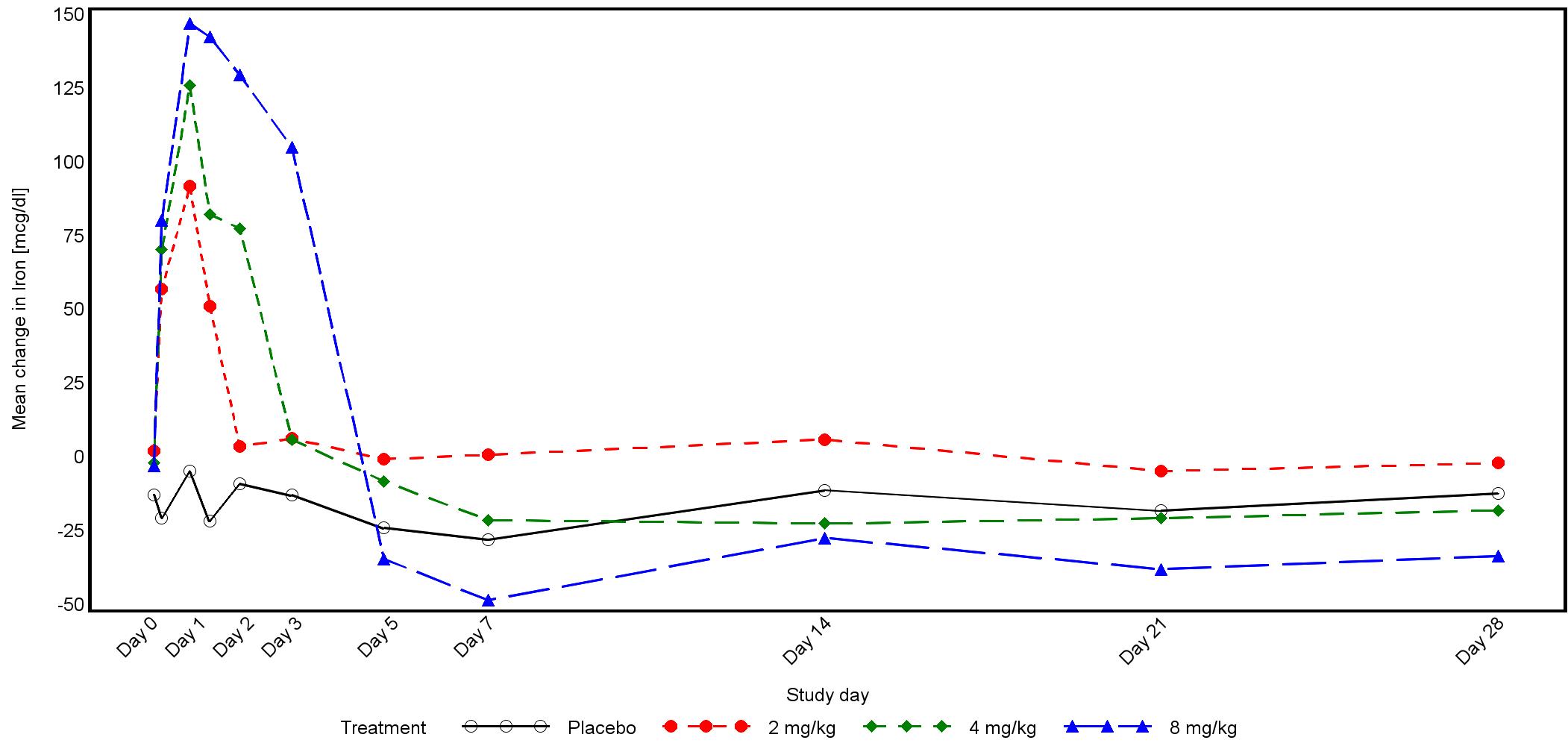

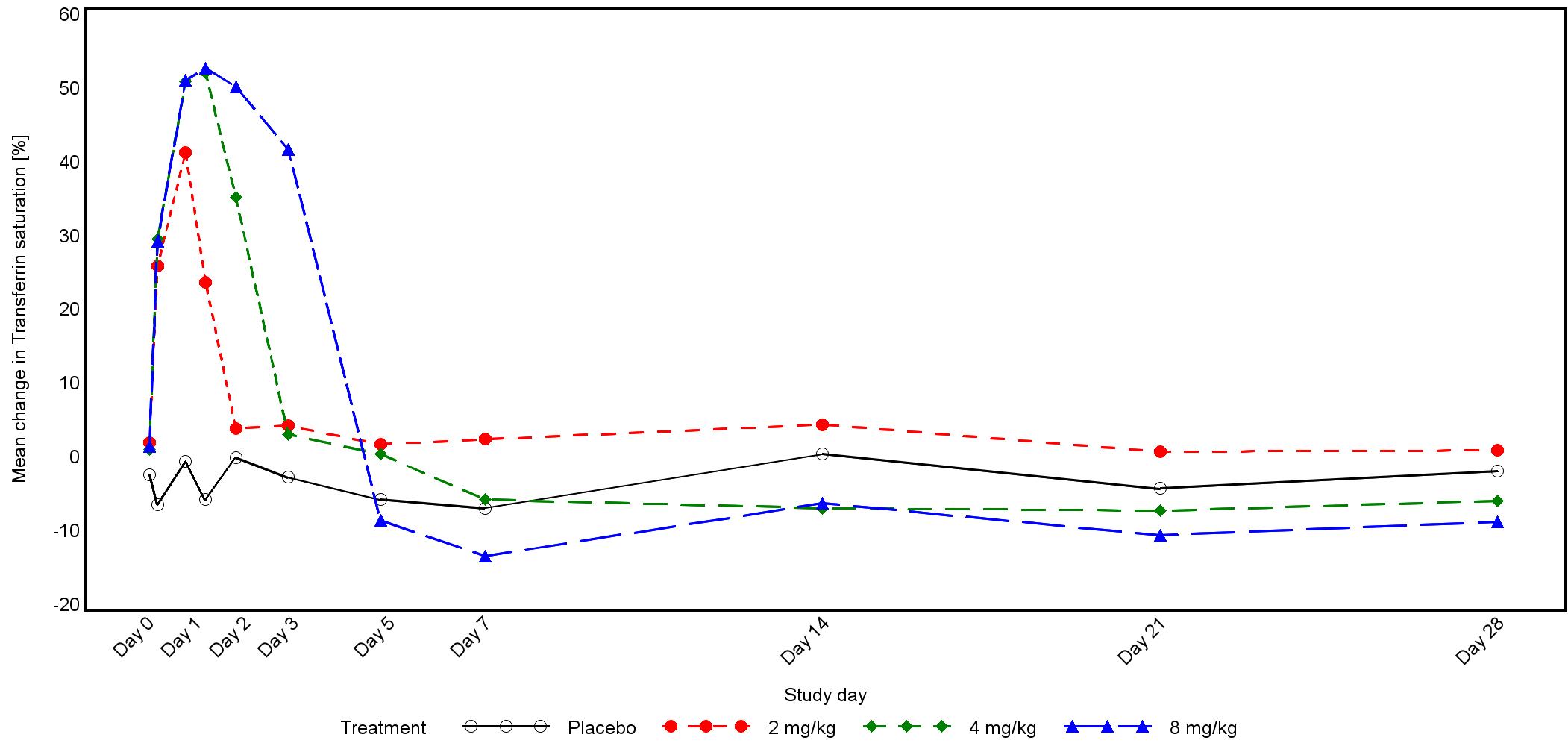

Phase 1 study design and results